Bitvo.com

Bitcoin (BTC)

C$10,988 (US$98,258)

October 7, 2019 2:00 pm

Shane Thomson, CFA

shane@bitvo.growmeconsulting.ca

403.407.0046

Technical Trading Score*:

Date Of Inception:

2009

Primary Use:

CURRENCY

18mm

Coin Profile

Bitcoin

is

a

decentralized

coin

enabling

revolutionary means to exchange value across the

globe. It continues to be the biggest and most

influential coin, encouraging peer-to-peer payment

networks powered by its users with no central or

middle authority.

Page 1 of 8

Coins Outstanding:

Maximum Coins:

21mm

POW or POS:

WORK

Current Mining Fee (USD):

~$0.476

Website:

https://bitcoin.org

October 7, 2019

All figures in USD$, unless otherwise specified

LOG IN TO VIEW

â– General Cryptocurrency News:

•

PayPal left the Libra Association last week. The payment processor stated

that it remains supportive of the stable coin’s aspirations but did not attend a

meeting of 28 Libra corporate backers held last Thursday.

•

Eight large cryptocurrency companies including Coinbase, Kraken, Bittrex,

Circle, Grayscale, Genesis, Cumberland and Anchorage announced a

collaboration to define which digital assets most closely resemble securities,

in their opinion. The organization dubbed the Crypto Ratings Council rates

digital assets on a scale of 1 through 5, with the highest score indicating that

they believe an asset should be considered a security.

•

Uzbekistan announced it is raising the price of power supplied to

cryptocurrency miners. The Minster of Energy introduced a bill that will

increase power rates by up to three times the rate miners currently pay.

â– BTC News:

•

The Bitcoin Lightning Network hit a new milestone with the number of nodes

reaching an all-time high of over 10,000 nodes.

•

Bitcoin futures products continue to develop and enter the market. Last

week, investment management company Stone Ridge filed a prospectus for

a new Bitcoin futures offering with the United States Securities and

Exchange Commission (SEC). The fund is called NYDIG Bitcoin Strategy

Fund and will offer a cash-settled Bitcoin futures product.

•

This announcement comes after Bakkt’s much-anticipated, physically settled

Bitcoin futures product went live in late September 2019.

•

Also in September, Binance launched two futures testnet platforms and the

Chicago Mercantile Exchange Group announced it will add options to its

Bitcoin futures contracts in the first quarter of 2020, pending regulatory

review.

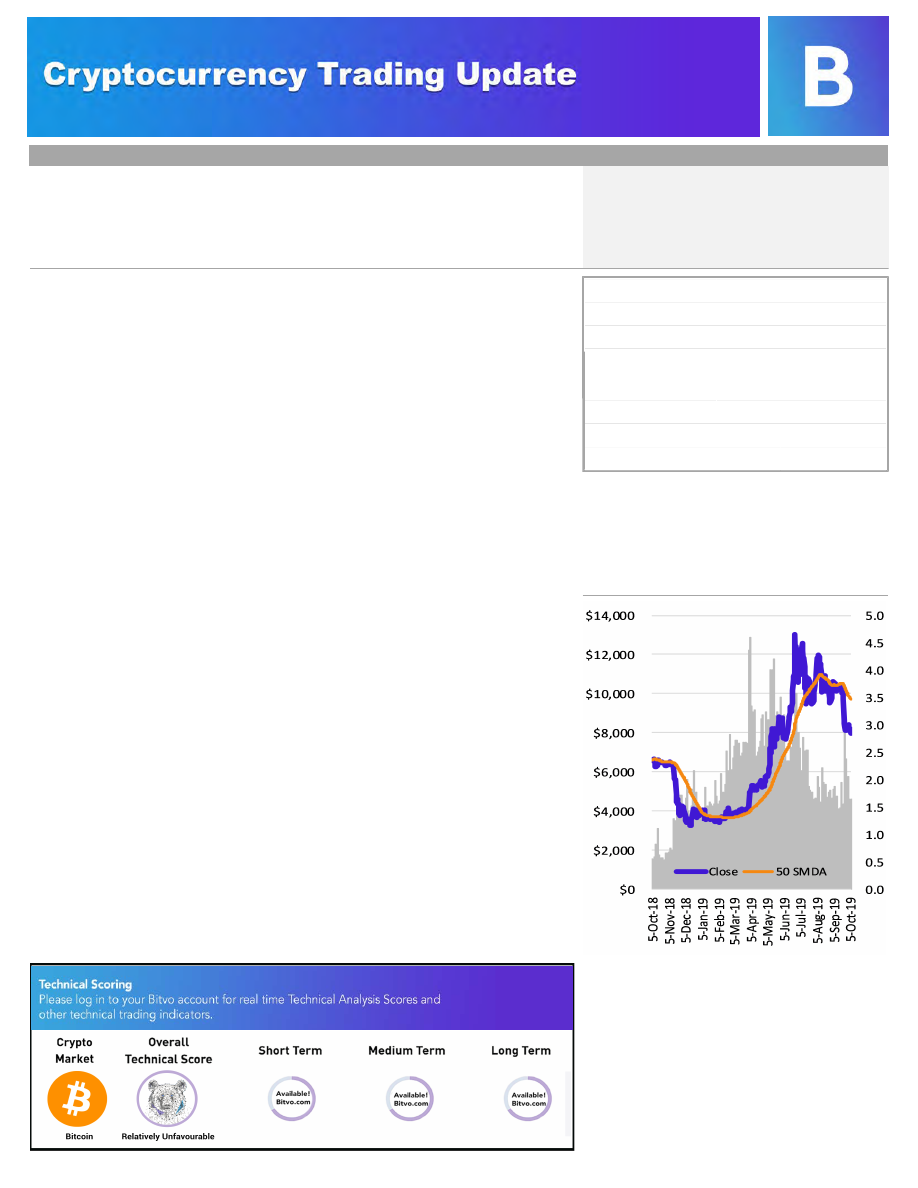

â– Trading History YTD:

•

Since the end of June, the price of BTC has traded sideways to negative

with successive peaks achieving lower highs and support levels declining

through US$8,000.

â– Current Environment:

•

After a brief rally to start the week last week, the price of BTC declined

throughout the week to as low as the high-US$7,000s before rebounding

again to the low-US$8,000s.

•

Volumes for the week were similar week over week, averaging 1.7 million

coins per day.

In the image above, a Bull represents relatively favourable technical analysis indicators and a Bear represents relatively unfavourable technical analysis indicators.

Bitvo.com

Technical Trading Score*:

Date Of Inception:

2014

Primary Use:

SMART CONTRACTS

Coins Outstanding:

107mm

Coin Profile

Ethereum is a decentralized platform that runs

smart contracts: applications that run exactly as

programmed without any possibility of downtime,

censorship, fraud or third-party interference. These

apps run on a custom built blockchain. Ether is the

cryptocurrency generated by and used on the

Ethereum platform.

Maximum Coins:

NO MAX

POW or POS:

WORK

Website:

https://www.ethereum.org/

Ether (ETH)

C$241 (US$181)

October 7, 2019 2:00 pm

All figures in USD$, unless otherwise specified

Page 2 of 8

Shane Thomson, CFA

shane@bitvo.growmeconsulting.ca

403.407.0046

~$0.129

Current Mining Fee (USD):

LOG IN TO VIEW

â– ETH News:

•

Citing an anonymous source, Bloomberg indicated that the

Venezuelan Central Bank is considering buying Bitcoin and Ether for

its currency reserves. Venezuela has experienced hyperinflation for

the last few years making it more expensive in domestic terms to

buy foreign assets.

•

The Ethereum test network forked two days earlier then expected,

catching some miners off guard as many had not yet upgraded to

the new fork. This has created some instabilities in the test network

but has no impact on the production Ethereum network.

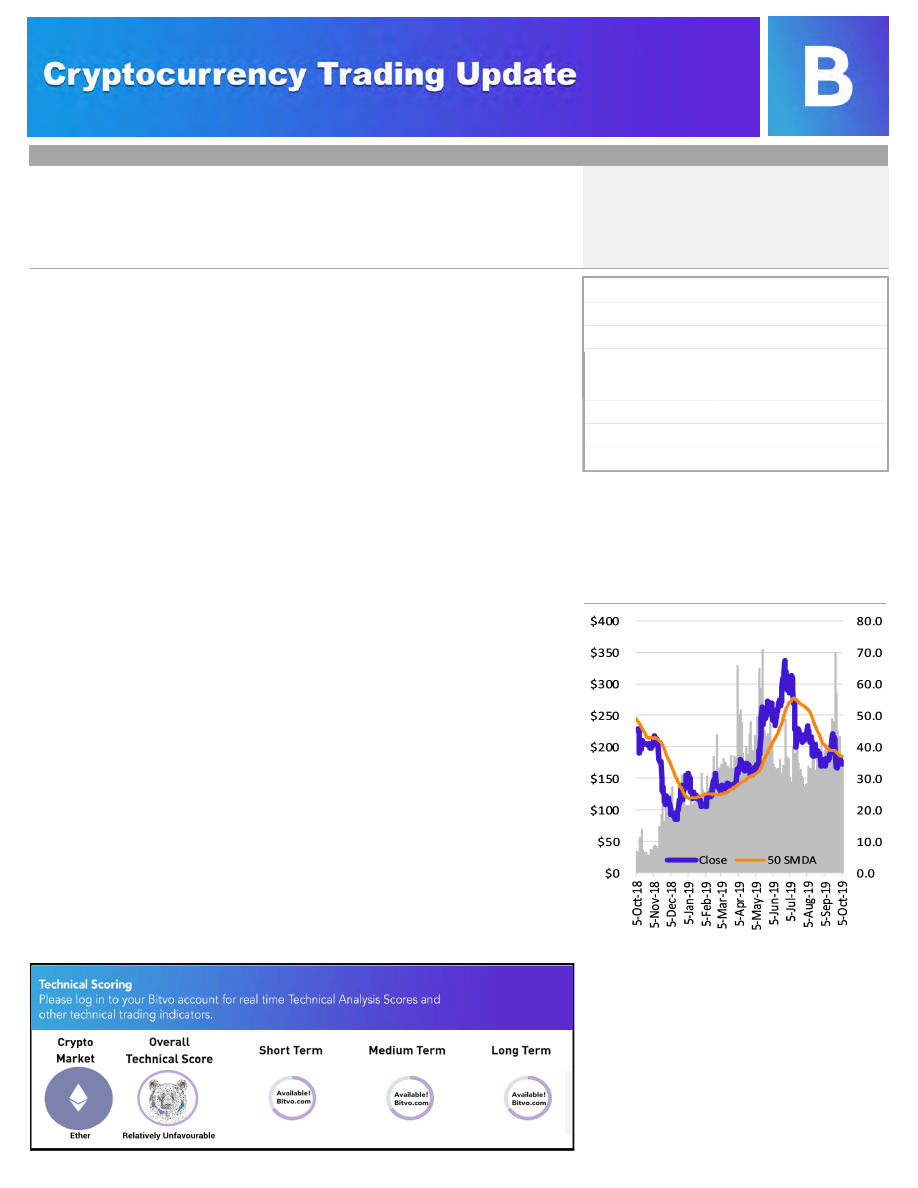

â– Trading History YTD:

•

The price of ETH commenced the year relatively stable before

accelerating in May and then falling July onwards.

•

While the price of ETH has given up most of its year to date gains,

it remains in positive territory on the year in USD terms.

•

However, with the positive performance of BTC in 2019, ETH has

underperformed BTC, with the price of ETH in BTC terms generally

trending down since the end of February.

â– Current Environment:

•

The price of ETH trended sideways last week in USD terms while

the coin outperformed BTC in the latter half of the week, resulting in

the price of ETH ending the week up in BTC terms.

•

Volumes for the week averaged 37.0 million coins per day, which is

slightly lower than the previous week’s volumes of 37.1 million

coins per day.

In the image above, a Bull represents relatively favourable technical analysis indicators and a Bear represents relatively unfavourable technical analysis indicators.

October 7, 2019

Bitvo.com

Technical Trading Score*:

Date Of Inception:

2012

Primary Use:

CURRENCY

99.99 Billion

Coin Profile

XRP is the decentralized native currency employed by

Ripple. Ripple is a settlement system, currency

exchange and remittance network created by Ripple

Labs Inc. It is built upon a distributed open source

internet

protocol,

and

supports

tokens

representing

fiat

currency

or cryptocurrency.

The

company

purports

to

enable "secure,

instantly

and

nearly

free

global

financial

transactions of any size with no chargebacks."

Coins Outstanding:

Maximum Coins:

POW or POS:

CORRECTNESS

Website:

https://ripple.com/

XRP

C$0.37 (US$0.27)

October 7, 2019 2:00 pm

All figures in USD$, unless otherwise specified

Page 3 of 8

Shane Thomson, CFA

shane@bitvo.growmeconsulting.ca

403.407.0046

~$0.0003

Current Mining Fee (USD):

LOG IN TO VIEW

100 Billion

â– XRP News:

•

Web monetization platform Coil now supports XRP payments in real

time due to a partnership with payment gateway and XRP Ledger wallet

provider GateHub. A news release published last week revealed that

Coil users can now use GateHub to receive funds in XRP and convert

them into Euros, United States Dollars, Bitcoin and Ether.

•

Xpring, the investment arm of Ripple, announced that it acquired Logos

Network. This acquisition will help Ripple develop decentralized finance

products that will use XRP, adding to XRP’s use cases.

•

Xpring has also created a platform that will allow application developers

to integrate the XRP ledger into apps in multiple programing languages.

•

BitPay, a global leader in allowing crypto payments to fiat merchants,

announced it will begin offering XRP.

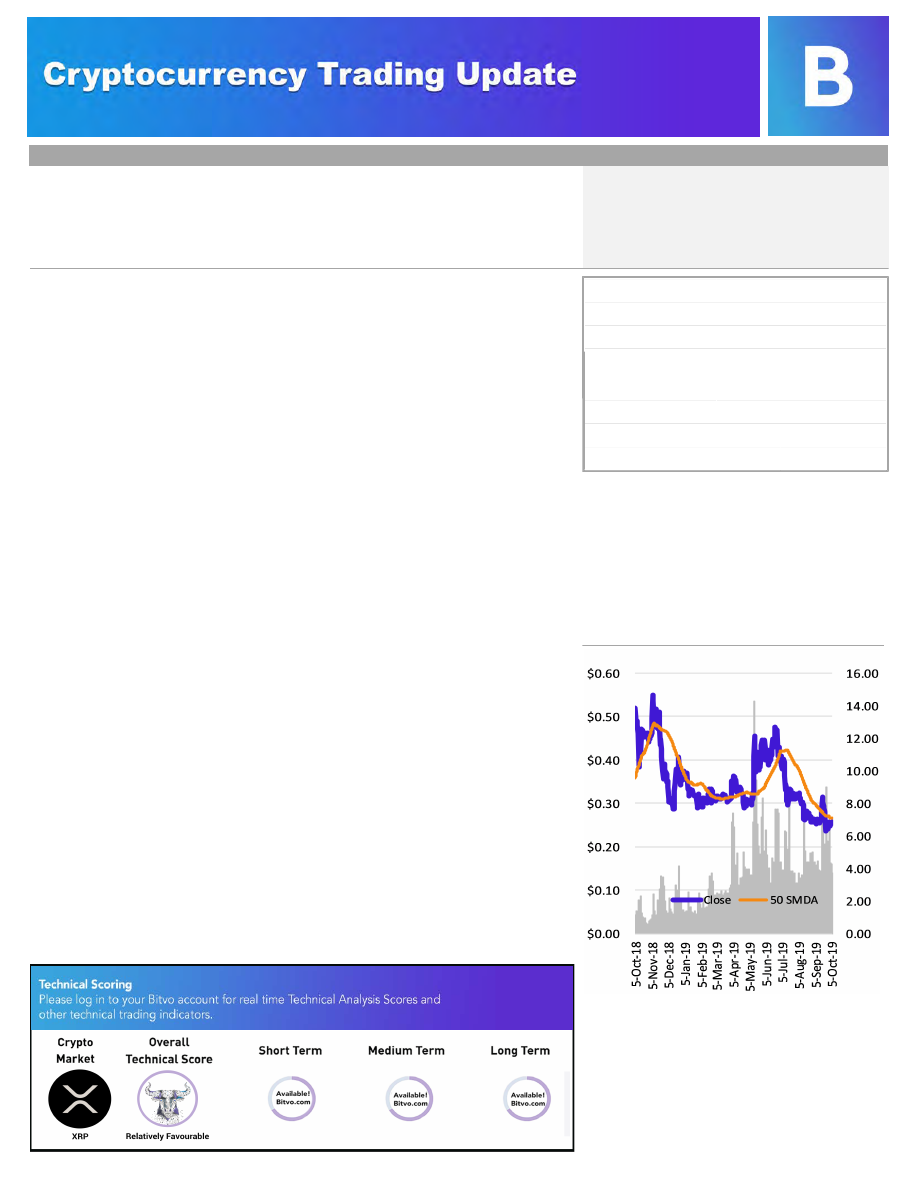

â– Trading History YTD:

•

XRP has underperformed other major cryptocurrencies so far in 2019,

with its price trending down or flat from January through May.

•

While XRP participated in May and June’s almost universal

cryptocurrency price rally, it did not benefit to the same extent as other

major cryptocurrencies.

•

Overall, the price of XRP is down on the year in USD terms and, as a

result of the above noted underperformance versus other

cryptocurrencies, the price of XRP has declined steadily in terms of

BTC since the beginning of 2019.

â– Current Environment:

•

XRP was an outperformer amongst other major cryptocurrencies last

week, trending sideways for most of the week before spiking over the

weekend, both in USD and BTC terms.

•

Volumes for the week averaged 4.57 billion coins per day, which is

lower than the previous week’s volumes of 5.81 billion coins per day.

In the image above, a Bull represents relatively favourable technical analysis indicators and a Bear represents relatively unfavourable technical analysis indicators.

October 7, 2019

Bitvo.com

Technical Trading Score*:

Date Of Inception:

2017

Primary Use:

CURRENCY

18mm

Coin Profile

Bitcoin Cash is peer-to-peer electronic cash for

the Internet. It is fully decentralized, with no central

bank and requires no trusted third parties to operate.

Bitcoin Cash is the continuation of the Bitcoin project

as peer-to-peer digital cash. It is a fork of the Bitcoin

blockchain ledger, with upgraded consensus rules

that allow it to grow and scale.

Coins Outstanding:

Maximum Coins:

21 mm

POW or POS:

WORK

Website:

https://www.bitcoincash.org/

Bitcoin Cash (BCH)

C$313 (US$243)

October 7, 2019 2:00 pm

All figures in USD$, unless otherwise specified

Page 4 of 8

Shane Thomson, CFA

shane@bitvo.growmeconsulting.ca

403.407.0046

~$0.0011

Current Mining Fee (USD):

LOG IN TO VIEW

â– BCH News:

•

No significant BCH related news last week.

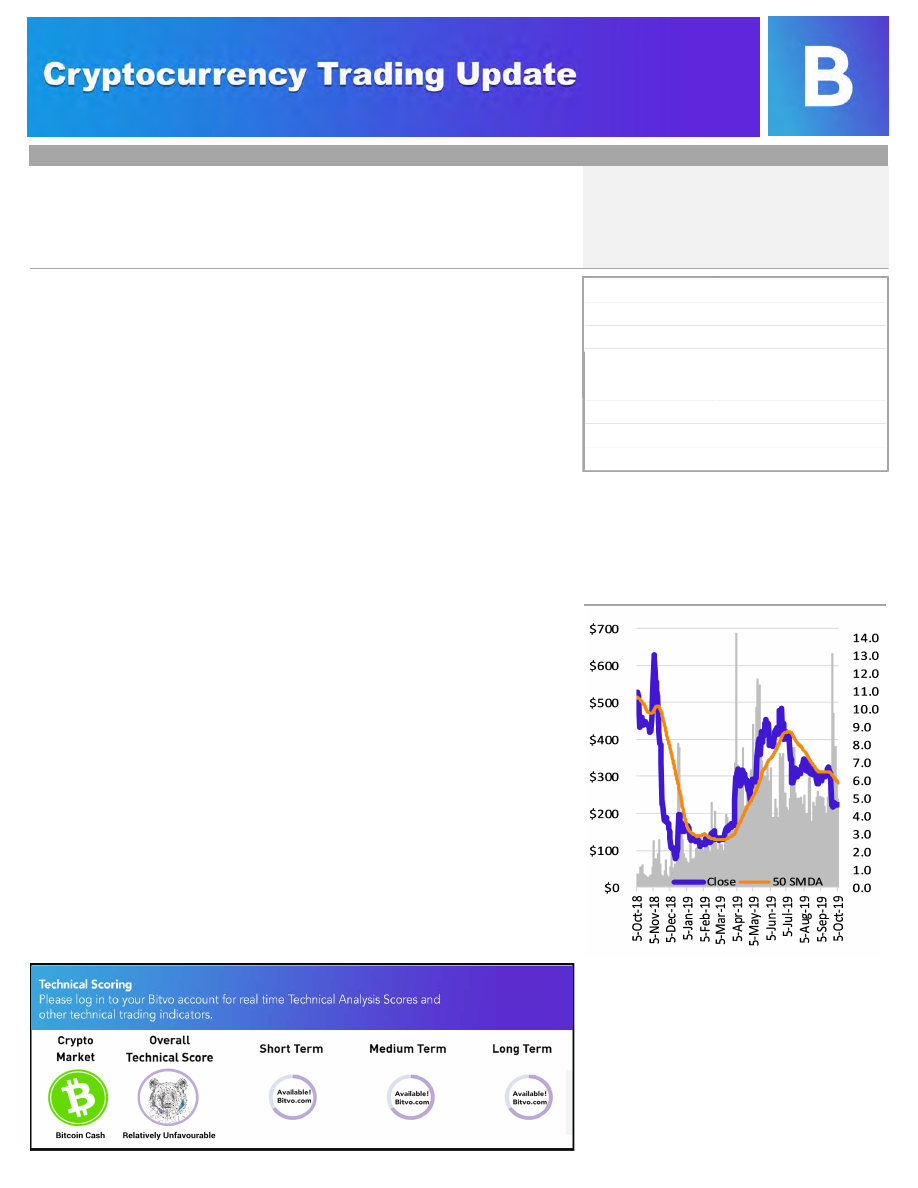

â– Trading History YTD:

•

Somewhat similar to the trend in the price of BTC, the price of BCH

ground sideways for the first quarter of 2019 before experiencing a

price spike in early April.

•

The price of BCH has trended sideways to negative since the

beginning of April in both USD and BTC terms.

â– Current Environment:

•

The price of BCH declined early in the week last week and rebounded

in the latter part of the week, resulting in it ending the week

approximately where it began both in USD and BTC terms.

•

Volumes were lower week-over-week, averaging 5.9 million coins per

day compared to the previous week’s 8.8 million coins per day.

In the image above, a Bull represents relatively favourable technical analysis indicators and a Bear represents relatively unfavourable technical analysis indicators.

October 7, 2019

Bitvo.com

Technical Trading Score*:

Date Of Inception:

2011

Primary Use:

CURRENCY

62mm

Coin Profile

Litecoin

is

a

peer-to-peer

cryptocurrency

and open source software project released under

the MIT/X11 license. Creation and transfer of

coins is based on an open source cryptographic

protocol and is not managed by any central authority.

The coin was inspired by, and in technical details is

nearly identical to, Bitcoin.

Coins Outstanding:

Maximum Coins:

84 mm

POW or POS:

WORK

Website:

https://litecoin.com/

Litecoin (LTC

C$77 (US$58)

October 7, 2019 2:00 pm

All figures in USD$, unless otherwise specified

Page 5 of 8

Shane Thomson, CFA

shane@bitvo.growmeconsulting.ca

403.407.0046

~$0.035

Current Mining Fee (USD):

LOG IN TO VIEW

â– LTC News:

•

Litecoin continues to fall in rank in terms of market capitalization, falling

to number six overall last week from number five previously as Tether’s

market capitalization increased to overtake that of Litecoin’s.

•

Reaching as high as fourth earlier in 2019, Litecoin’s current market

capitalization is now US$3.7 billion behind Bitcoin, Ether, XRP, Bitcoin

Cash and Tether.

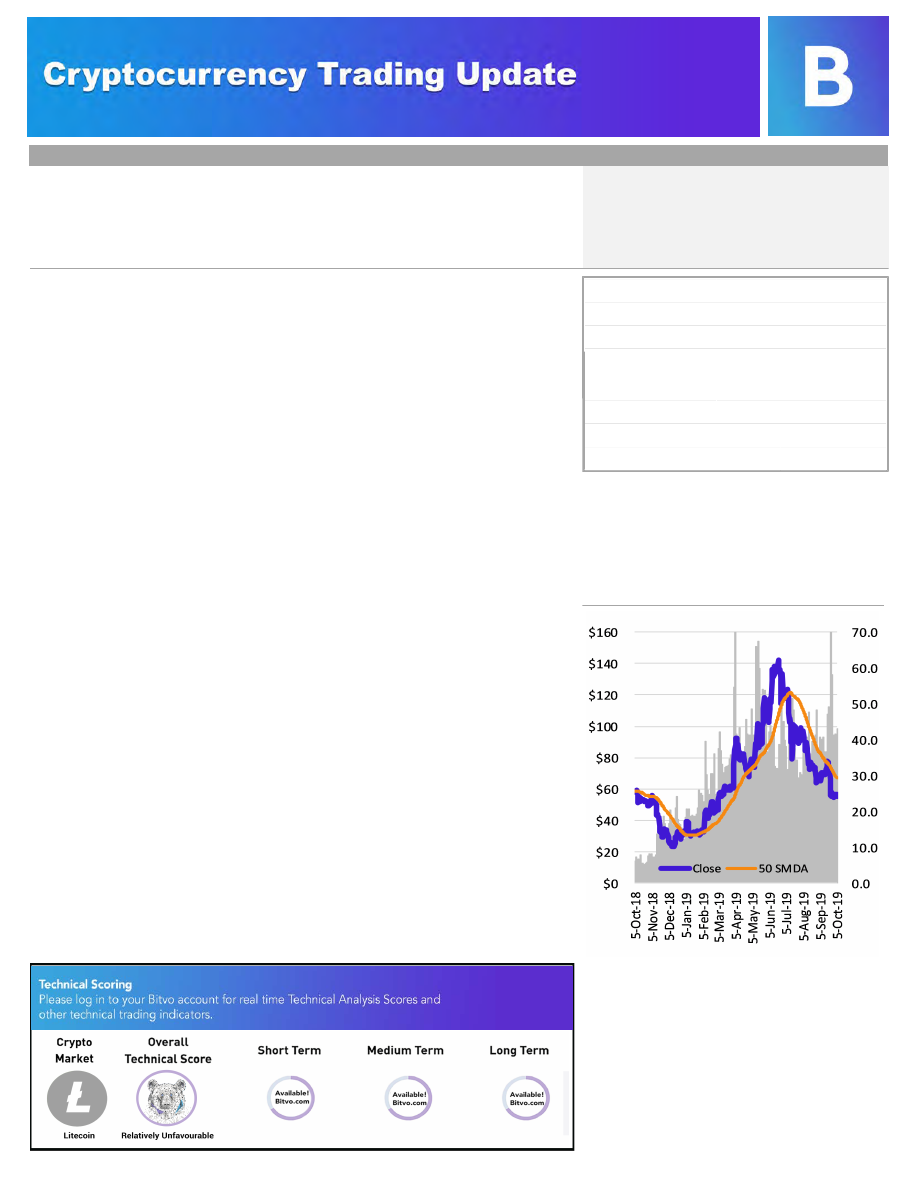

â– Trading History YTD:

•

Having started 2019 as a relative outperformer in comparison to other

major cryptocurrencies, the price of LTC lost momentum in April

onwards, but for a brief recovery in June.

•

The price of LTC in USD terms has traded in positive territory for all of

2019 year to date. However, as a result of the above noted recent

underperformance, the price of LTC is now down on the year in BTC

terms.

â– Current Environment:

•

The price of LTC traded sideways for most of the week last week before

spiking over the weekend in USD terms.

•

In BTC terms the price of LTC also ended up on the week after some

volatility and movement both up and down.

•

Volumes last week averaged 39.7 million coins per day which was lower

than the previous week’s volume of 47.8 million coins per day.

In the image above, a Bull represents relatively favourable technical analysis indicators and a Bear represents relatively unfavourable technical analysis indicators.

October 7, 2019

â– DASH News:

•

Wallet service provider BitGo announced a Dash staking program on its

secure custodial platform that allows its users to earn passive recurring

income from their Dash holdings. This passive income stream

compliments CrowdNode’s pooled masternodes, which allows anyone

with over one Dash to gain a proportional share of each month’s block

rewards.

•

Gentarium, a masternode, mining, and loan management platform, has

integrated Dash support for masternode hosting as well as for

masternode shares. The platform claims to host 6,297 total masternodes

across several chains, amounting to US$1.9 million, and offers both

masternode hosting as well as pooled masternode shares.

•

UTRUST, a cryptocurrency payment solution, has integrated Dash

payments enabling Whow Games, an online social gaming platform with

over nine million users globally, to offer instant transactions, buyer

protection, and crypto-to-cash settlements.

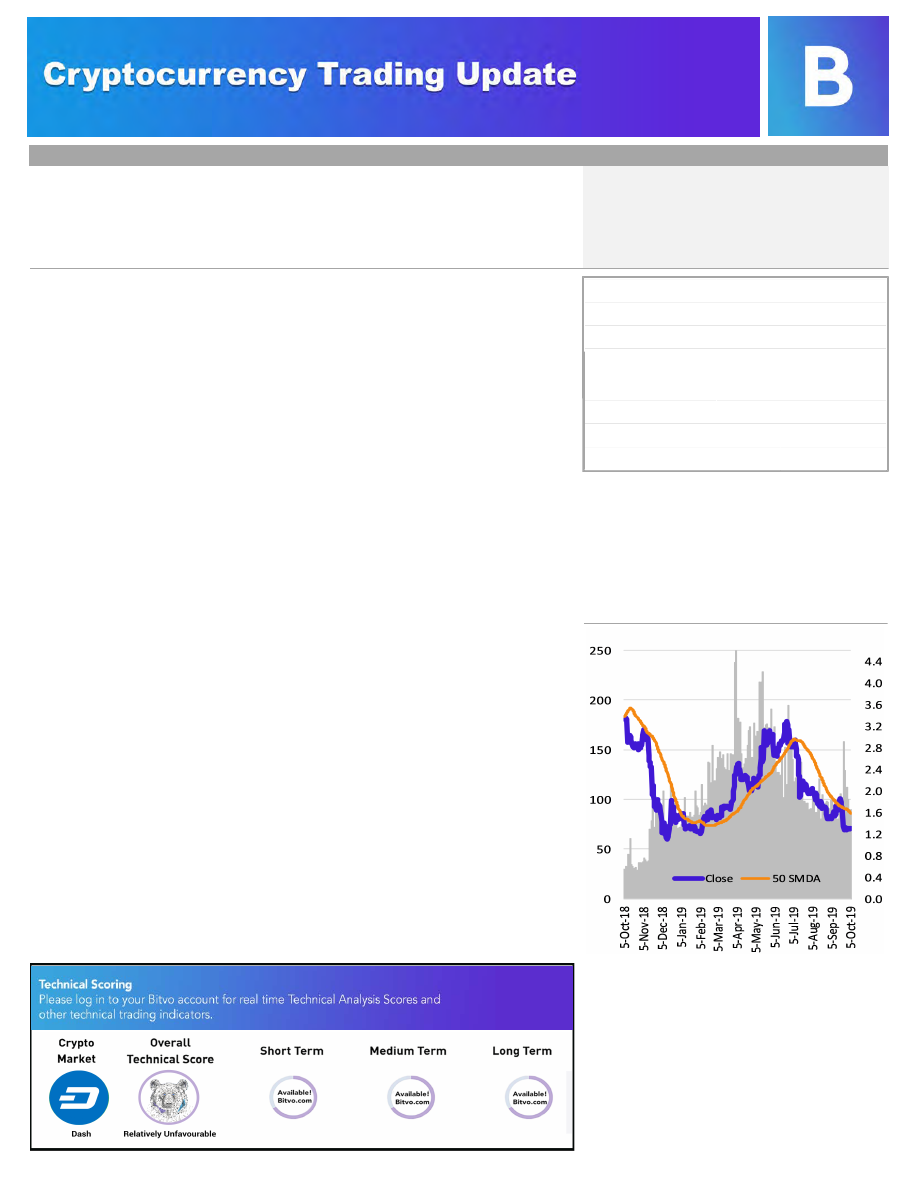

â– Trading History YTD:

•

After a generally stable start to the year, the price of Dash increased in

USD terms from April through June before declining July onwards.

•

Accounting for movements both up and down, the price of Dash is now in

negative territory for the year both in USD and BTC terms.

â– Current Environment:

•

The price of Dash was volatile last week. Accounting for some sharp

movements both up and down, the price of Dash ended the week slightly

above where it began in BTC terms.

•

Volumes were similar week-over-week, averaging 1.7 million coins per

day.

Bitvo.com

Technical Trading Score*:

Date Of Inception:

2014

Primary Use:

CURRENCY

9 mm

Coin Profile

Dash is an open source peer to peer cryptocurrency.

On top of Bitcoin’s feature set, it currently offers instant

transactions, private transactions and operates a self-

governing and self-funding model that enables the

Dash network to pay individuals and businesses to

perform work that adds value to the network. Dash’s

decentralized governance and budgeting system

makes it a decentralized autonomous organization.

Coins Outstanding:

Maximum Coins:

22 mm

POW or POS:

STAKE

Website:

https://www.dash.org/

DASH (DASH)

C$95 (US$72)

October 7, 2019 2:00 pm

All figures in USD$, unless otherwise specified

Page 6 of 8

Shane Thomson, CFA

shane@bitvo.growmeconsulting.ca

403.407.0046

~$0.006

Current Mining Fee (USD):

LOG IN TO VIEW

In the image above, a Bull represents relatively favourable technical analysis indicators and a Bear represents relatively unfavourable technical analysis indicators.

October 7, 2019

Bitvo.com

Technical Trading Score*:

Date Of Inception:

2016

Primary Use:

112 mm

Coins Outstanding:

Maximum Coins:

POW or POS:

WORK

Website:

https://ethereumclassic.org/

Ethereum Classic (ETC)

C$6.25 (US$4.70)

October 7, 2019 2:00 pm

All figures in USD$, unless otherwise specified

Page 7 of 8

Shane Thomson, CFA

shane@bitvo.growmeconsulting.ca

403.407.0046

~$0.002

Current Mining Fee (USD):

Coin Profile

Ethereum Classic is an open-source, public,

blockchain-based distributed computing platform

featuring smart contract (scripting) functionality. It

provides a decentralized Turing-complete virtual

machine, the Ethereum Virtual Machine (EVM), which

can execute scripts using an international network of

public nodes. ETC has a value token called "ether",

which can be transferred between participants or stored

in a cryptocurrency wallet.

LOG IN TO VIEW

NO MAX

SMART CONTRACTS

â– ETH Classic News:

•

No significant ETC related news last week.

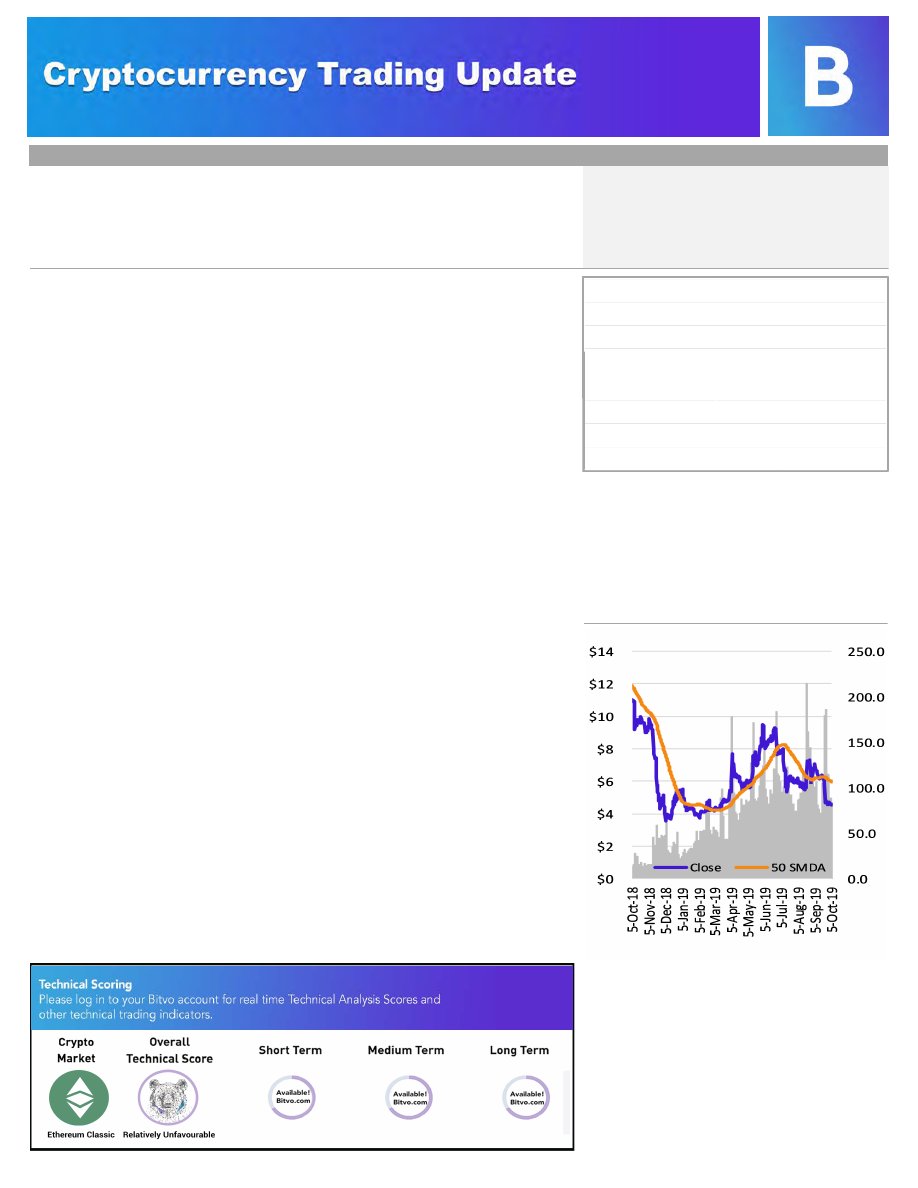

â– Trading History YTD:

•

•

After trading sideways for most of the first quarter of 2019, the price of

ETC benefited from broader spring momentum in the cryptocurrency

space, trading generally positively from April through the end of June,

before correcting again July onwards in terms of USD.

However, ETC has generally underperformed other major

cryptocurrencies with its price trending negatively throughout most of

the year to date in terms of BTC.

â– Current Environment:

•

The price of ETC traded sideways throughout the week last week, both

in USD and BTC terms.

•

Volumes were lower week-over-week, averaging 91.9 million coins per

day compared to the previous week’s volumes of 127.4 million coins

per day.

In the image above, a Bull represents relatively favourable technical analysis indicators and a Bear represents relatively unfavourable technical analysis indicators.

October 7, 2019

Bitvo.com

DISCLAIMER

The information contained in this report has been compiled by Bitvo Global Inc. (“Bitvo”) from sources believed to be reliable, but no

representation or warranty, express or implied, is made by Bitvo, its affiliates or any other person as to its accuracy, completeness or

correctness. All opinions and estimates contained in this report constitute Bitvo’s judgement as of the date of this report, are subject to

change without notice and are provided in good faith but without legal responsibility. Nothing in this report constitutes legal,

accounting or tax advice or individually tailored investment advice. This material is prepared for general circulation to clients and has

been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The Bull and Bear

symbols represent relatively favourable or unfavourable technical indicators, respectively, and the presence or absence of these

symbols and any language pertaining to these symbols does not represent any advice, representation or guidance from Bitvo as to

whether you should buy, sell or hold any cryptocurrency. The cryptocurrencies or services contained in this report may not be suitable

for you and it is recommended that you consult an independent advisor if you are in doubt about the suitability of such

cryptocurrencies or services. This report is not an offer to sell or a solicitation of an offer to buy any securities. Past performance is not

a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. The cryptocurrency market

is volatile and rapidly changing and, as a result, the latest published reports available to clients may not reflect recent material

changes. Bitvo reports are current only as of the date set forth on the reports. This report is not, and under no circumstances should

be construed as, a solicitation to act as securities broker or dealer in any jurisdiction by any person or company that is not legally

permitted to carry on the business of a securities broker or dealer in that jurisdiction. To the full extent permitted by law neither Bitvo

nor any of its affiliates, nor any other person, accepts any liability whatsoever for any direct or consequential loss arising from any use

of this report or the information contained herein. No matter contained in this document may be reproduced or copied by any means

without the prior consent of Bitvo.

Page 8 of 8

October 7, 2019