______________________________________

I would be surprised if 10 years from now we’re not using electronic currency in some way, now that we know a way to do it

that won’t inevitably get dumbed down when the trusted third party gets cold feet.

Satoshi Nakamoto, January 7, 2009

____________________

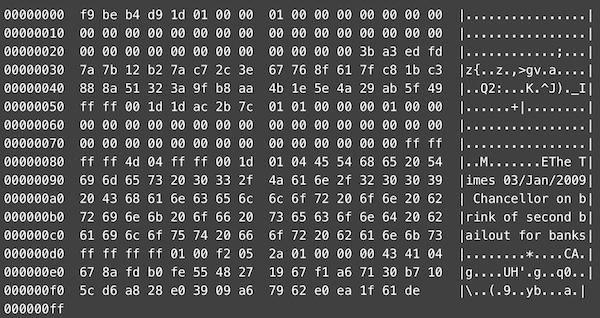

The Bitcoin Genesis Block

Eleven years after our last major financial meltdown and the birth of Bitcoin, we have another financial surprise. The world economy has been put in a coma as it tries to deal with a highly virulent virus. Billions of people have moved from productive citizens to government cheques.

Everything is being tested, including the crypto narrative.

For the most part, crypto hasn’t done too badly. There were some problems, a few growing pains, but at its core, the main crypto infrastructure has remained robust and dynamic. As Satoshi predicted, we are using some form of digital currency, in fact, several of them, the question is, what comes next?

There is a well-trodden path blazed by various innovations throughout history. By examining the evolution of technology adoption, we can see the future of the financial system in context. And what lies before us is a giant chasm of fear, uncertainty and doubt.

The bridge across will be perilous, fraught with mistakes and danger, but by looking into the past, we can find the path forward.

Netscape was the window into a strange new world

Back in 1993, a couple of ambitious guys built a gateway to a strange new world. They had one problem, a dispute over the name Mosaic inspired a new project. This new project gave people a look into the virtual world to come. It helped to develop a powerful network that spread virally across the globe.

That gateway, Netscape, co-founded by Jim Clark and a young Mark Andreesen, now founding partner of a16z, was a seminal moment. A number of our current most influential technology enterprises began in the decade following the opening of the gateway into the new worldwide web. Names like eBay, Yahoo, Craigslist, Amazon, Google and Alibaba, to name a few.

The 90s into the new Millenium also saw massive development of fibre optic network infrastructure and companies built to use that infrastructure.

Then 2000 came, and the whole internet evolution got napalmed.

Overinvestment, bubbly markets and abused trust all culminated in a dramatic market decline and several failures. But when the smoke cleared, we discovered two valuable things. One was that there was a framework to clear the financial rubble, and the other was the infrastructure for the economic growth of the future.

Innovation means waste and learning

In his must-read book: Doing Capitalism in the Innovation Economy, Willam Janeway traces the history of the relationship between venture capital, government and entrepreneurship in the development of innovation. The lessons he explores can be applied to our situation in crypto today.

One point is about the value of waste in the innovation process. The other is how waste leads to valuable future productive capacity and infrastructure.

Waste is often viewed in a negative light these days. If it doesn’t produce immediate ROI, it usually won’t get funded. Indeed, science itself is a process of discovery, based around a sort of waste. Lots of experiments are conducted to test hypotheses and advance knowledge by disproving those hypotheses.

As George Gilder often reminds us, “Wealth is knowledge and growth is learning.”

Janeway explores several innovation booms and busts over history as a guide. These include the canals of early England, the American railway boom and bust, and the internet boom in the 90s and dot-bomb, circa 2000.

In each case, innovation was developed, investors became overly enthusiastic, a bubble ensued, popped, and capital was destroyed. But what remained was a powerful infrastructure that led to an increase in productive capacity. There were new industries and the foundation for the next stage of growth in the economy.

Cryptocurrency has a roadmap to follow

When the Dot Com bubble burst, an apparent overabundance of fibre optic cables had been built at exorbitant prices. Companies with no revenue or profits went from market darling to the financial morgue. But when the smoke cleared, there was a powerful network to build on, lots of new fresh ideas that had been too early, and a vision of the future.

The system cleared up the deadwood by writing off destroyed capital, punishing malfeasance, and providing assets for stronger well-capitalized hands to acquire and develop.

Like all of the great infrastructure booms of the past, Bitcoin started quietly based on learning and waste from previous ideas and iterations. And once again, the 90s feature prominently here with David Chaum’s DigiCash in 1994, Adam Back’s Hashcash in 1997, Wei Dai’s B-money in 1998, and Nick Szabo’s Bitgold idea coming a little later in 2005.

Like Netscape, Bitcoin opened up a vision of what a new financial infrastructure could be. What money could be.

Bitcoin goes from 9 pages to Xanax and alcohol

Bitcoin came to be in a time of financial failure that never really ended. And over the years that followed, this obscure digital unit, representing something unknown, has become an alternative vision of finance. It started with one program combining several innovations, described in 9 pages, that morphed into more than two thousand projects through 2017.

The 2017 boom was followed by a massive bust. ICO enthusiasm was followed by Xanax and alcohol. Scams and malfeasance followed the boom and collapsed into reality as they do with all such bubbles.

The reality check resulted in massive capital destruction marked by a dust cloud of broken ICO’s and failed projects. What remains is information from thousands of experiments, the waste byproduct of learning and advancement.

What was left at the bottom in 2018 was a powerful infrastructure, and lots of new ideas that arrived before their time. The development of cryptotokenomoics has since exploded to over five thousand projects in 2020.

Crypto meets margin call disruption

March 2020 has provided some valuable stress testing of this infrastructure.

Bitcoin’s plunge demonstrated the challenges of borrowing certain aspects of the legacy financial product mix without adequate controls and limits. If you are wondering if you should be trading Bitcoin with leverage, you should take a look at March 12, 2020, for an example of the potential consequences.

We found out what happens if you use a CDP (collateralized debt position) structure with crypto collateral when the margin reaper calls. Maker’s smart contract structure imploded as Ether got creamed in response to correlation across the entire crypto space. Leverage and an unstable user base (aka human beings) plus a flawed smart contract was a toxic mix. Catastrophic losses led to a reexamination of the protocol and the infusion of the USDC stablecoin to help stave off total failure.

Decentralized Finance or DeFi had some problems of its own just before that. Hackers made bank using lightning-fast arbitrage to exploit weak smart contracts in a part of the DeFi ecosystem. The BZx mistake wasn’t fatal but showed some places where more work needs to be done.

That’s some of the bad stuff, but there were some interesting discoveries as well.

Bitcoin don’t need no stinkin’ bailout

What was interesting was that the Bitcoin infrastructure didn’t falter. While the legacy system was getting a $6 trillion epinephrine infusion to keep it from coding, little old Bitcoin kept chugging along. It was volatile and got some severe margin call beatings; the clearing times widened temporarily to 15 minutes instead of 10, but it didn’t stop.

Another interesting development happened in the stablecoin space where USDC saw massive inflows. The timing of Canada’s QCAD stablecoin release by Stablecorp could not have been more prescient.

While governments deliberate how to get cash into the hands of citizens, the flaws of our system are on full display. Looking at stablecoins as a payment rail, could capital be quickly and directly delivered to citizens using this new architecture?

Could stablecoins as a payment rail be the missing piece of a puzzle to help citizens in adverse situations like these?

As companies look for more efficient and cheaper ways to pay their employees, contractors, suppliers and taxes, could a cryptocurrency payment rail provide a solution? And can this rail be adapted to improve things like supply chain efficiencies?

Or could this rail be used as the foundation for a new identity protocol making it faster, easier and more accessible for people to get the services they need?

While others debate whether Bitcoin is the new gold or a hedge of some kind, we can see it as something much more. Cryptocurrency, with its various components, provides us with ways to address old and new problems. But cryptocurrency has a problem of its own.

It’s called the chasm.

Crypto in the chasm

Innovation isn’t supposed to be pretty, clean, or perfect. Innovation is messy, sometimes destructive and involves waste. The wider adoption of buying crypto will involve moving along the technology adoption curve. It will have to cross the chasm.

In Geoffrey Moore’s book: Crossing the Chasm, he talks about the technology adoption lifecycle. The curve is the process a tech company goes through when building a company. Moore also details the personas of the various buyers of technology from the very early innovators, adopters all the way to the laggards.

The most important part of the curve is the chasm. This is the space after the first two segments of the curve, the innovators and early adopters, and before the big enterprise buyers that make up the early majority.

The chasm is the place where many tech companies fail.

Tech companies fail in the chasm because they refuse to transition their marketing and thinking designed for the early customers, to a message and thinking that works for big corporations.

Because it is the big corporations, not the innovators and early adopters, that will help them scale from a startup into billion-dollar entities. He lists this as one of several mistakes that a company makes in the chasm that can result in failure.

For cryptocurrency, the early majority is represented not just by big companies, but by mass adoption of the public.

There are many voices telling everyone that crypto is going mainstream. That this crisis is the beginning of the end. And yet, these messages are preaching to the converted innovators and early adopters, not the early majority.

The early majority wants easy to understand

Let’s think about this in more physical terms. Let’s imagine a car. It has a body, a design, colour and perhaps a leather interior and chrome across the top of the windows.

What would happen if we took the body off the car and removed the leather interior? How would that look?

It would be a mess of wires, rivets, metal, foam insulation, a motor, and in the eyes of many, intimidating and ugly. Same car, just a different vision.

This vision is not only intimidating, but you might also describe it as disruptive. It would be hard to sell this technological wonder to anyone other than a pure car enthusiast, engineer or hobbyist. These people understand the potential, the promise and the opportunity, These are your innovators and early adopters.

Now taking that car out to the general public, the early majority, provides a problem. They will not buy something that’s intimidating and disruptive. They don’t want revolutionary things.

People want things that work and have low friction. People want things they can look at and conceptualize.

So for this audience, you have to cover that mess of wires, foam, rivets and safety equipment with a beautiful shell. You’re going to have to add seats with nice materials and carefully choose the colour.

Same car, but now the intimidation factor is removed, and the promise can be envisioned.

How can crypto make a better life?

Now, the reason this is important is that, during all this chaos, opportunities abound for crypto development and adoption. But the question is, do people want to hear about the engine, wires, foam, rivets, bolts, and cool tech involved? Or do they want to see what that thing can actually do with a nice shiny cover, chrome window edging and sexy lines instead?

Do they want to hear how bad the system they are clinging to is failing while innovators and early adopters pontificate about how Bitcoin is going to a gazillion? Do they care that its superior tech, hash rates are exploding and that there is no human intervention?

Or do they want something that will help them during a pandemic and economic armageddon to help them get through with less pain?

Maybe what they really want is the infrastructure on which to build a new, better life, on their terms.

The power of bitcoin and the entire crypto space is the foundation for a new vision of the future. A new infrastructure on which to build the prosperity of the years ahead. But that will only become a reality if we put the cover on and move beyond the language and thinking of the innovator and early adopter.

For crypto, it’s time to cross the chasm.

______________________________

Bitvo is a trading platform that facilitates buying, selling and trading cryptocurrencies such as bitcoin, ether, dogecoin, XRP, cardano and litecoin through its website and mobile applications. Bitvo differentiates itself by making transacting in cryptocurrencies easier than anyone else and offering proprietary features such as the Bitvo Same Day Guarantee, the Bitvo Cash Card and technical analysis tools. Contact us at 1 833-862-4886 or support@bitvo.com.