Mainstream. That’s a word you wouldn’t associate with crypto a year ago.

It was a niche asset class. Maybe even a quiet rebellion.

In crypto circles where you talked of nothing but crypto, it was all-consuming. Outside of that, it was news headlines that captured the public’s imagination.

With Bitcoin over US$50,000 and Ether solidly in the four-figure category, it’s mainstream now.

Governments were paying attention before. Now they are looking at their own digital currencies.

Corporations are allocating parts of their capital into Bitcoin in a game theory competition.

The quiet revolution taking place in crypto has in part been facilitated by stablecoins.

Stablecoins have acted as the bridge between traditional banking and crypto. It blends something money managers know with something new.

It provides institutional crypto traders a way to manage entry and exit into the cryptosphere. It helps cut the costs and delays of moving resources.

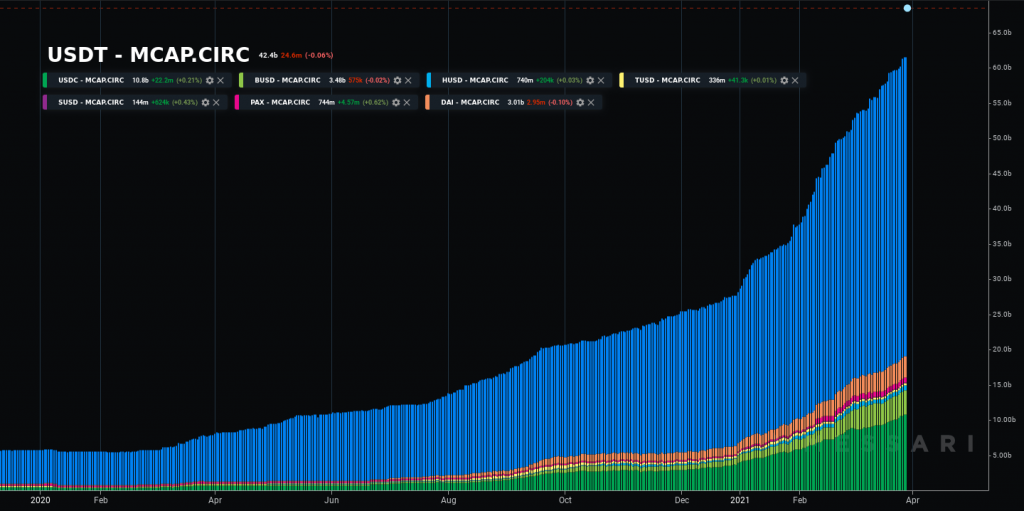

What started with USDT has blossomed into several stablecoins and stablecoin concepts around the world. The space has grown from under $5 billion in March 2020 to over $62 billion twelve months later.

And the core of the stablecoin market is the Ethereum platform and the ERC-20 standard.

What is a stablecoin?

A stablecoin takes the idea of the gold standard and loosely applies it to a digital currency. In the gold standard, dollars were exchangeable for an ounce of gold at a set price.

The gold standard enforced fiscal prudence and reduce the depreciation of money. Or put another way, the gold standard was designed to keep inflation at bay.

So using a similar concept, stablecoins are a digital currency backed by a set amount of an asset. For example, 1 QCAD is equal to 1 CAD. Or in the case of USDC, 1 USDC is equal to 1 US dollar.

It is not the same as being backed by a hard asset, but the principle is the same. Stablecoins are an asset with a more or less fixed value over time. And by fixed, that means the 1:1 exchange rate in this case.

A fixed value makes it easy to exchange without concerns about volatility.

You could say that a fiat-backed USDC and the dollar are technically and contextually fungible assets.

The beauty of a stablecoin is due to its use of cryptocurrency architecture. As a result, stablecoins are not one thing. Think of them as an evolving programmable and flexible technology product.

They are easy and cheap to transfer. Technically borderless. And a short-term form value storage.

A stablecoin can act as a payment network, a financial asset and a derivative.

They solve some crypto problems

Crypto is relatively fast, peer to peer, secure and cheap. It cuts a lot of friction when moving resources internationally.

But crypto also presents a couple of problems.

Depending on how you interpret Bitcoin, it’s a store of value or a currency. When you use it as a currency, the inherent volatility is a problem. For an individual looking for trading gains, this isn’t an issue. For a business trying to manage currency exposure, it’s a risk and a distraction.

Stablecoins provide virtually all the benefits of a fiat currency and a cryptocurrency together. It eliminates the volatility element of cryptocurrency while preserving the major benefits. It’s easy to exchange and acts as a measure of value between different assets. The only thing you miss is the capital gains or losses.

Stablecoins, like other crypto assets, are borderless. They move to wherever they’re accepted and can be used. Digital dollars can move in and out of a country on a peer-to-peer basis without bank oversight.

This is why they have become essential for trading and arbitrage across international crypto exchanges.

Stablecoins are a bridge for the financial system

Stablecoins were designed to help address the issues of working between two parallel financial architectures. Getting in and out of the crypto market through the traditional banking system can be cumbersome and time-consuming. There can be additional fees.

Once in the crypto system, the process is comparatively seamless.

With a stablecoin, moving in and out of Bitcoin and holding a cash-like digital asset became a trading advantage. That’s where USDT (Tether) played an important role in terms of international trading arbitrage.

So stablecoins have acted as an important bridge between crypto and traditional banking. While stablecoins haven’t been embraced to a large extent in Canada, they are more widely adopted elsewhere.

In Canada, Stablecorp, a partnership between Mavennet and 3iQ, launched QCAD. They have followed up with a new stablecoin offering called VCAD.

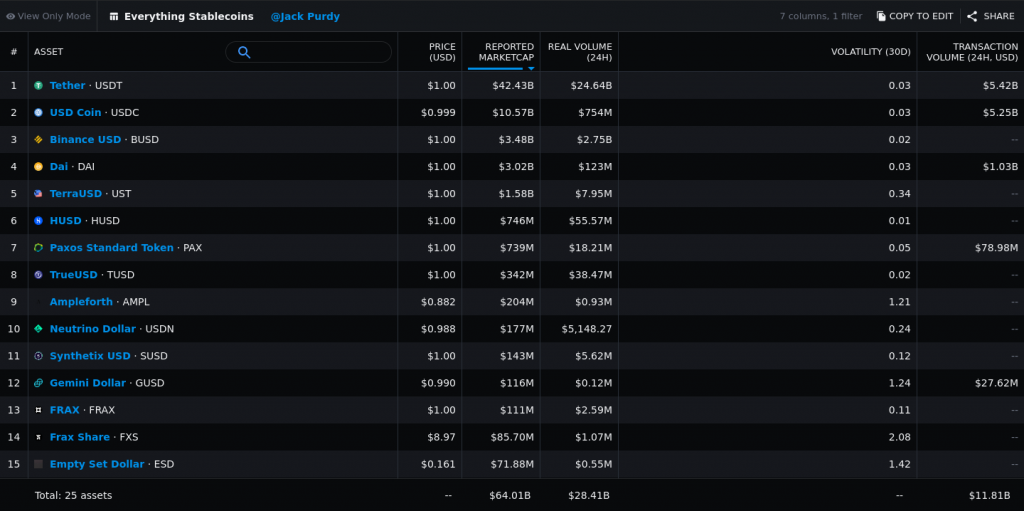

In the US, stablecoin products and usage has expanded significantly. Jeremy Allaire’s Circle partnered with Coinbase to found USDC. USDC has become the number two stablecoin since the beginning of 2020. There are also TerraUSD and Paxos Standard amongst the top fiat-backed projects.

There are also fiat-backed stablecoins that explored using a multi-currency basket approach. This was the proposal by Facebook’s Libra. In this case, they would manage several currencies as the underlying value for the Libra token. This presented a complex asset management problem for the consortium.

Libra has been rebranded as Diem and built around a single dollar-backed or pegged stablecoin.

Around the world, other projects explore alternative stablecoin approaches. These include asset-backed and purely algorithmic stablecoins.

Hard asset stablecoins

Unlike dollar-backed stablecoins that rely on fiat currency or a basket of currencies, some stablecoins are backed by hard assets. These assets might be gold, silver or other metals.

In this stablecoin model, you buy a token representing ownership of a certain quantity of a metal.

For gold, you have proof of ownership of a small portion of a gold bar, either a gram or an ounce. The physical gold is held in accredited vaults. The coin or token is usually redeemable for cash. In some cases, like with Pax Gold, you can redeem the token for physical bullion.

The ability to facilitate fractional ownership with crypto means you can accumulate micro positions with ease.

Like other stablecoins, the token is a representation of the asset. This makes it borderless and easy to transfer to others.

Some examples of gold-backed stablecoins are Pax Gold, Tether Gold, and Digix Gold Token.

Like currency-backed stablecoins, you can also use a basket approach for metals. The downside here is the management of the value of the coin. Surprise supply events for one or more metals in the basket can be challenging when maintaining a stable value.

The derivative stablecoin approach

Another kind of stablecoin is backed by a crypto asset or cryptocurrency. The most well-known example here is MakerDAO, which acts more like a traditional derivative.

To offset the underlying crypto asset’s inherent volatility, depositors supply a multiple of the collateral required. The deposit is held as a collateralized debt product (CDP), a type of derivative called Vault.

Maker’s approach using Ether as collateral took a well-publicized hit during the crash of March 2020. They added USDC as approved collateral following the event.

Maker provides ways to use it as either a dollar tracking stablecoin or to earn yield staking.

The other stablecoin approach uses smart contracts exclusively and has no underlying asset to track. These are referred to as algorithmic stablecoins. The value is maintained by minting and burning coins based on a pure supply and demand model. The purely algorithmic model remains an interesting experiment and prone to problems.

Of these three models, the fiat-backed stablecoin is the most dominant and readily available.

Central banks are watching

There are numerous stablecoin projects taking place around the world. The stablecoin index shows more than 30 projects, the biggest of which is Tether. The ECB has indicated that there are about 50 projects underway in Europe. There are numerous others taking place around the globe.

In the US, the Office of the Comptroller of the Currency (OCC) has opened up federally chartered banks and thrifts to using stablecoins. This is a big step towards wider adoption of stablecoins by the general public in the United States.

Simultaneously, there are a variety of national payment network updates taking place.

In Europe, they are working on the Pan European Payment System Initiative (PEPSI). In Canada, a consortium manages a payment system through Payments Canada. They are exploring DLT payments through Jasper.

Stablecoins will be competing with these initiatives. They will also face potential competition from Central Bank Digital Currencies.

Central banks have generally been cautious about creating their own digital currencies. To date, only the central bank in the Bahamas has created and launched a CBDC (Central Bank Digital Currency). The rest are looking carefully at the implications of CBDCs on banking, monetary policy and regulations.

Even Visa, which has a payment infrastructure with Mastercard, has recently experimented with settling transactions in USDC.

For participants and users of cryptocurrencies, stablecoins provide a level of convenience and efficiency. Stablecoins also act as the easy gateway for broader participation of the general public into crypto.

Supported by the Ethereum blockchain, stablecoins represent a key but quiet part of the transition to crypto-dominated finance.

_________________________________________

You can buy, sell and trade BTC, ETH and more on Bitvo’s fast, easy and secure trading platform.

To sign up, click the orange button below and fill out the form.